Many small business owners find limited company tax and dividends confusing. Some accountants aren’t very good at explaining how it works. As a result, small business owners can make mistakes, and occasionally run into issues with HMRC. At We Grow Businesses we try hard to help small business owners to understand exactly how limited company tax and dividends work so they can be as tax efficient as possible. This blog post breaks it down step-by-step.

1. Net Profit

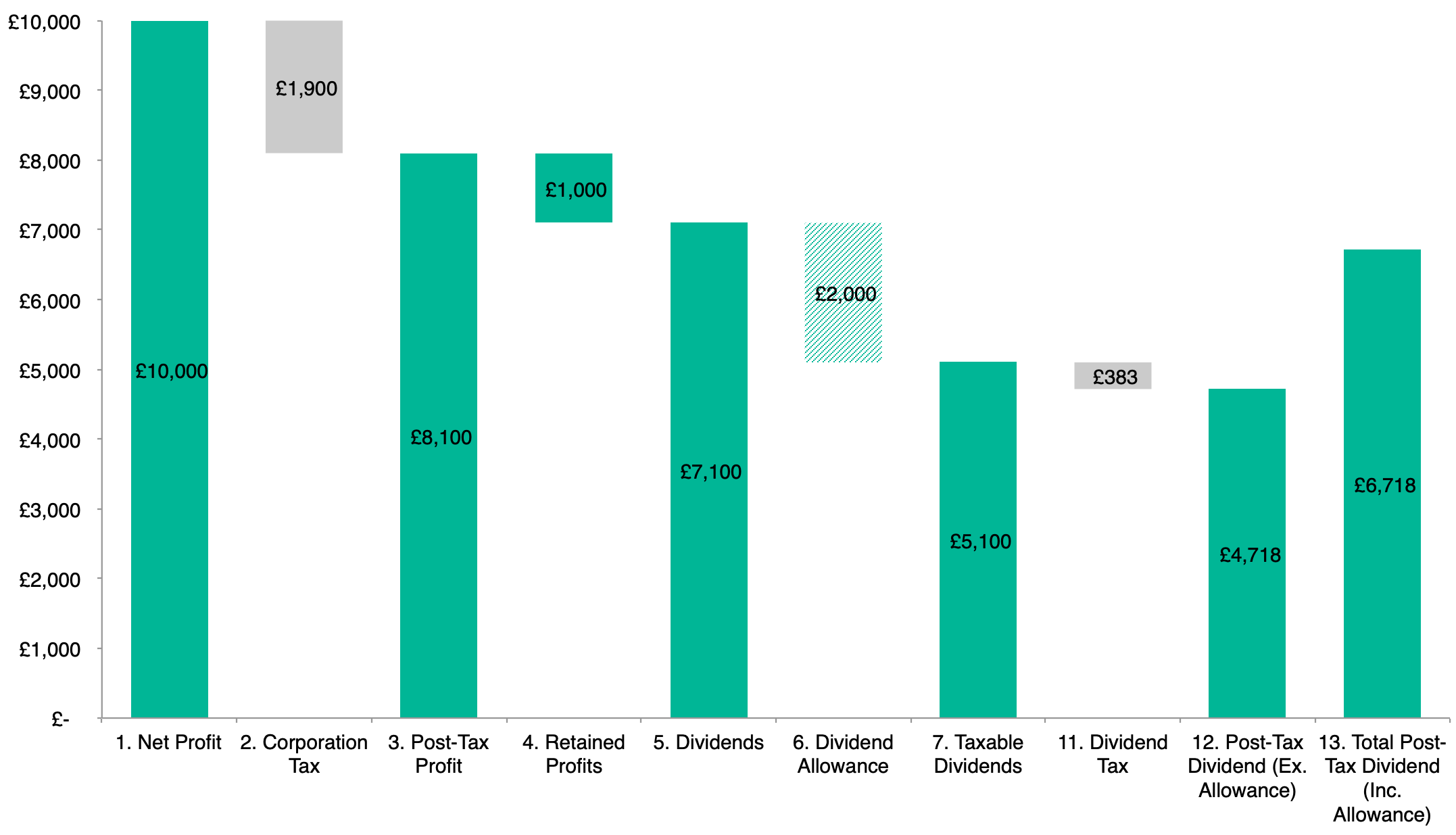

To kick this off, let’s imagine that a small limited company has made a profit of £10,000 (1).

2. Corporation Tax

Corporation tax is charged at 19% of net profit. So in this case, 19% of £10,000 = £1,900 (2).

3. Post-Tax Profit

If we subtract the corporation tax (2) from the net profit (1) then we get £10,000 – £1,900 = £8,100 (3). This is the post-tax profit.

4. Retained Profits

It’s up to the directors and shareholders of the business to decide how much of their post-tax profits they distribute as dividends, and how much they retain. Let’s say in this example they retain £1,000 (4).

5. Dividends

In this example, let’s say that £7,100 is distributed as dividends (5). In practice these dividends may well have been paid during the financial year, or might have been used to flatten an overdrawn director loan account balance.

It’s worth noting that it is illegal to take more money out of a limited company as dividends than it has available to distribute. In our example, if we had no distributable profits carried forwards from previous years then taking more than £8,100 as dividends would potentially be illegal.

6. Dividend Allowance

As part of our annual tax allowance, each individual is normally given a £2,000 allowance (6). In other words, they can receive £2,000 of dividends without paying any tax on them. Please note, this is a very simple example and there may be reasons why some people don’t get a dividend allowance – check with your accountant.

7. Taxable Dividends

After subtracting the dividend allowance, we’re then left with an amount of dividends that are taxable. In this example it’s £7,100 – £2,000 = £5,100 (7).

11. Dividend Tax

Tax on dividends depends on whether you’re a basic, higher or additional rate tax payer. Many small business owners pay 7.5% dividend tax. In this example, dividend tax is £5,100 * 7.5% = £383 (11).

12. Post-Tax Dividend (Excluding Allowance)

Almost there! If we subtract off the dividend tax then we’re left with the post-tax dividend, i.e. £5,100 – £383 = £4,718 (12).

13. Post-Tax Dividend (Including Allowance)

Finally, we can add the dividend allowance back in to calculate the total amount of dividend that the business owner can take home. £4,718 + £2,000 = £6,718 (13).

Find Out More About Limited Company Tax and Dividends

Limited Company Tax and Dividends are just one of many subjects that our clients ask us about and that we help them to understand.

The trick here is to make the most of the options that are available to get money out of your limited company as tax efficiently as possible. Classic examples are finding the right time to switch from sole trader to limited, and making the most of tax efficient salaries.

Click here to find out more about our Business Growth Service or our Free Business Growth Health Check.